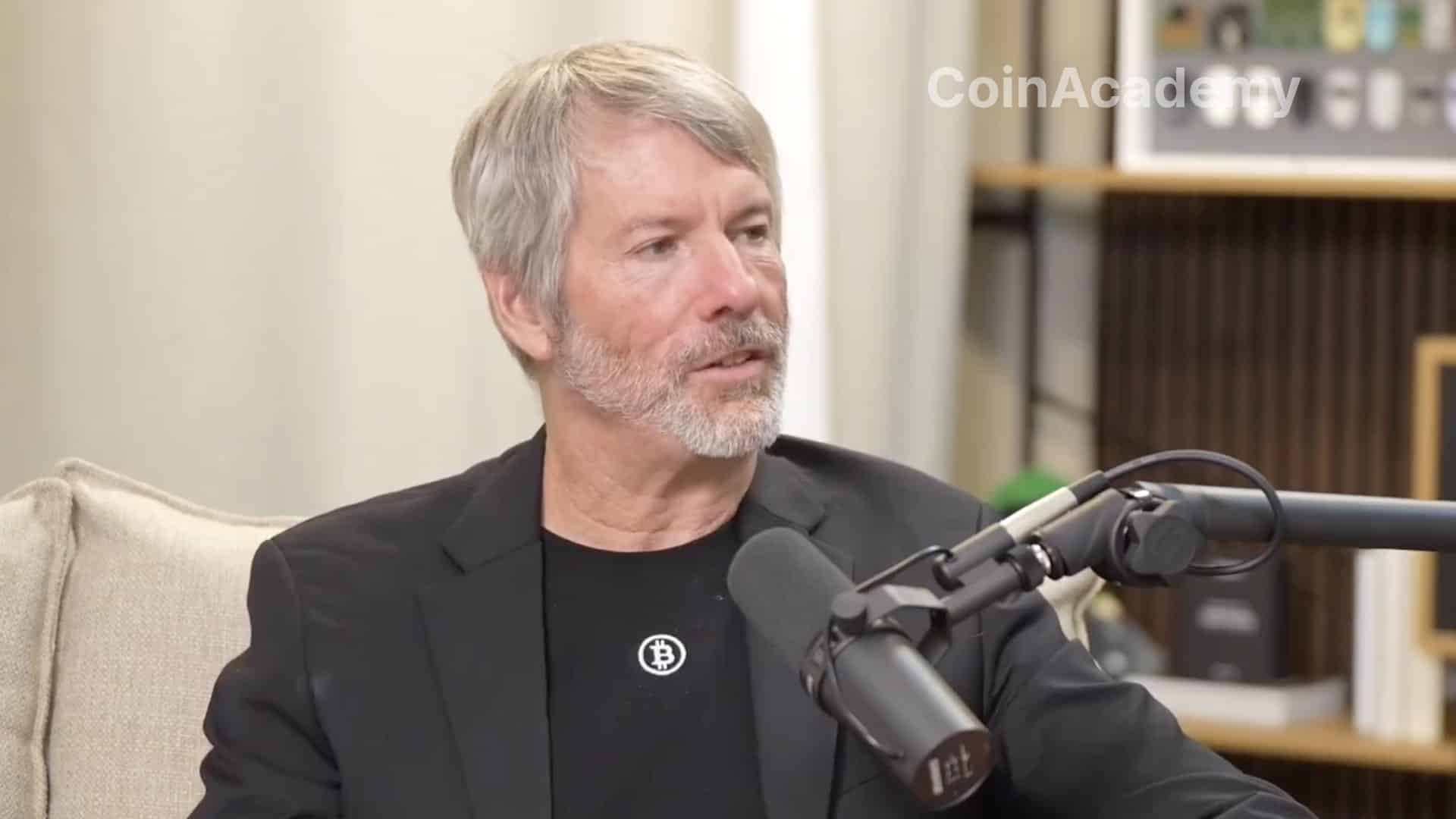

- MicroStrategy CEO Michael Saylor aims to transform the company into the world’s first major “bitcoin bank” with a valuation of more than $1 trillion.

- MicroStrategy has been massively hoarding Bitcoin by borrowing at low rates to invest directly in assets, now holding 252,220 BTC worth more than $15 billion.

- The company’s unique strategy is based on the belief that Bitcoin is the most valuable asset in the world, predicts exponential growth and an “infinitely scalable” model.

From 2020 MicroStrategy has established itself as a key player in the Bitcoin ecosystem and has amassed an impressive amount BTC while adopting a bold strategy under leadership Michael Saylor. While many companies are still hesitant to fully embrace digital assets, MicroStrategy has taken a radical path that Saylor says could transform it into the world’s first major “bitcoin bank”.

The trillion dollar goal: Michael Saylor’s vision

In a recent meeting with the brokerage firm’s analysts Bernstein, Michael Saylor set an ambitious vision MicroStrategy : to become the main bitcoin bank and finally a a $1 trillion company. Unlike traditional banks that lend funds, MicroStrategy wants to borrow money at low rates, offer slightly higher rates to lenders, and invest these funds in bitcoins. According to Saylor’s estimates, this model could generate a average annual return 29%putting the company on a path to exponential growth.

MicroStrategy has already made bitcoin accumulation a cornerstone of its financial strategy. WITH 252,220 BTC in his possessionfor an estimated value of more than 15 billion dollarsthe company became the largest holder of bitcoins among listed companies. Saylor estimates that this massive accumulation, which equates to approximately 1.2% of the total bitcoin supply, positions MicroStrategy as a key player in this market.

The company trades at a 50% premium, with more volatility and ARR, we can build a company that has a 100% premium on $150 billion in bitcoin and build a $300-400 billion company with the largest options market, the largest stock market.

After that, we will start moving into the fixed income markets and continue to buy more and more bitcoins. Bitcoin will get to millions of dollars per BTC, you know, and then we’ll create a trillion dollar business.

Bitcoin bank: a unique model

Ambition of Saylor it is clear: MicroStrategy does not seek to function as a traditional bank, but rather to play a central role in the Bitcoin capital markets. Using various financial instruments such as stocks, convertible bonds and preferred shares, the company wants to create a set of market instruments linked to Bitcoin and thus strengthen its position in this ecosystem. According to Saylor, MicroStrategy could achieve an award 300 to 400 billion dollarswith the ultimate goal of becoming a trillion dollar company.

Central to this strategy rests on Saylor’s belief that Bitcoin is “the most valuable asset in the world” and that’s his the price will continue to rise dramatically. He even considers a The price of BTC reaches millions of dollars in the coming years, which would be a major lever to make MicroStrategy a billionaire player.

Bitcoin focused funding strategy

One of the differentiated approaches to MicroStrategy is its capital management method. Unlike other companies that might lend their bitcoins or accept traditional financing models, MicroStrategy borrows money from the financial markets at low rates and invests it directly in bitcoins. According to Saylor, this strategy is much safer than lending to human counterparties, whether they are companies or governments.

Saylor defends this approach by arguing that “investing in bitcoins” is more profitable and less risky than classic loans. By borrowing billions of dollars and putting them into bitcoin, the company hopes to take advantage of the asset’s estimated 29% annual growth. Saylor is convinced that even in a more pessimistic scenario bitcoin would continue to grow significantlywhich offer much higher yields than traditional alternatives.

An inimitable strategy?

MicroStrategy managed to introduce a unique arbitrage model between traditional financial markets and the bitcoin market. By offering bitcoin-linked investment vehicles while benefiting from cheap debt, the company has created a framework that is difficult for other players to replicate. Even businesses like Bitcoin miners or cryptocurrency exchanges cannot match this approach due to their more complex financial structure or focus on multiple activities.

Model from MicroStrategy is based on an unwavering belief in Bitcoin as a store of value. Michael Saylor is encouraging other companies to follow this path, but so far few players have been able to adopt the same strategy at scale.

The future: unlimited growth?

Michael Saylor he does not hide his ambitions to make MicroStrategy a financial institution key in the bitcoin ecosystem. With the bitcoin market, he said, it could reach trillions of dollars, which is MicroStrategy’s ability to continue borrowing and investing in this asset could expand to infinity. Saylor believes that his model is “infinitely scalable”, with the potential to raise hundreds of billions of dollars more in the coming years.

The article MicroStrategy Will Become First $1 Trillion Bitcoin Bank, Saylor Says appeared first on Coin Academy